by AccountingBees. | Jun 2, 2025 | Uncategorized

Providing a payslip to an employee is mandatory in South Africa. The Basic Conditions of Employment Act (BCEA) requires that employers issue a payslip each time an employee is paid. These payslips must contain specific information such as the employee’s pay and...

by AccountingBees. | Jun 2, 2025 | Uncategorized

We will submit your income tax once a year once the annual financial statements has been completed and filing season at SARS is open. Income tax is due within one year from the end of the company’s tax year end. Companies are normally taxed on a flat rate of 27% but...

by AccountingBees. | Jun 2, 2025 | Uncategorized

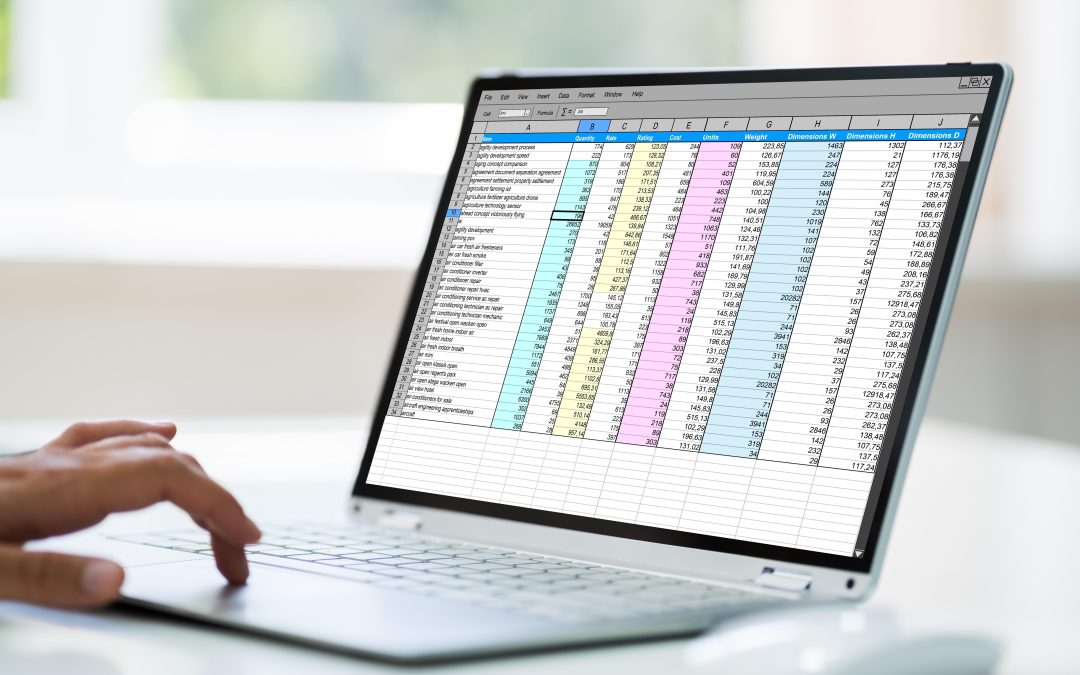

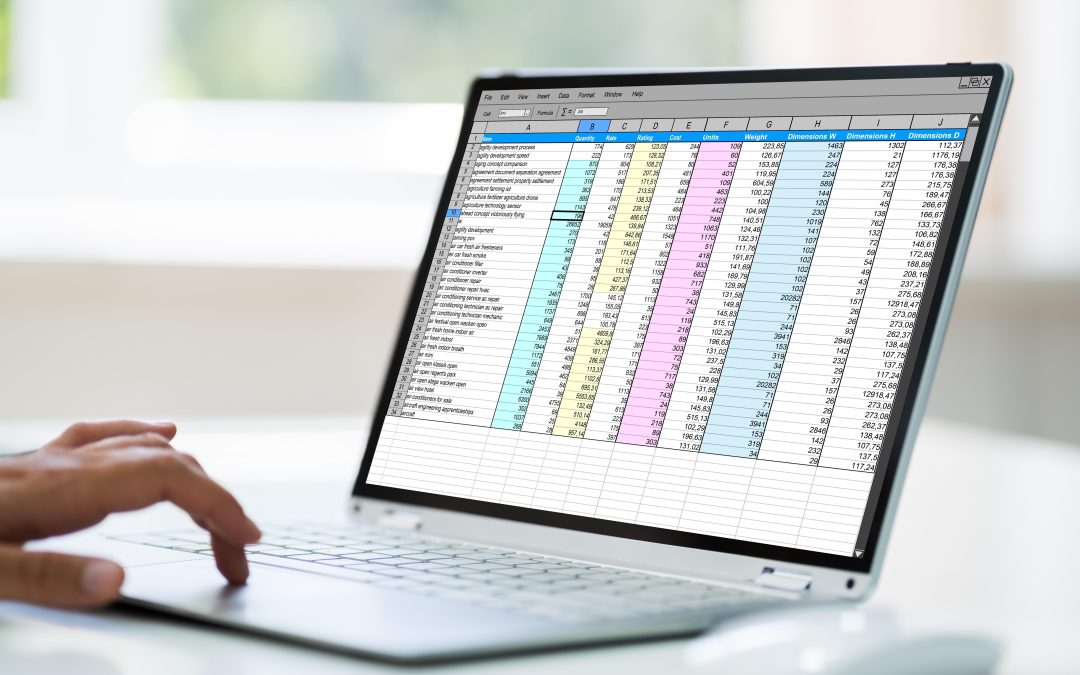

You will have access to our cloud-based software where you will be responsible for the invoicing of your clients and collecting the outstanding amounts. We will capture your supplier invoices on the system to account for VAT and supply you with a supplier age analysis...

by AccountingBees. | Jun 1, 2025 | Uncategorized

Once a year we will draft compiled annual financial statements so that you will comply with SARS and Companies Act legislation. In the context of the South African Companies Act, a company must prepare annual financial statements within six months of its financial...

by AccountingBees. | Mar 15, 2025 | Uncategorized

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!